So just in time for Christmas, Boris Johnson delivered the UK the Brexit deal we have been waiting for, but what does it mean for shipping?

From 1st January 2021 the UK has moved to trade under the new Free Trade Agreement (FTA, known as the Trade and Cooperation Agreement (TCA) which covers goods moving from the UK to the EU and visa versa.

The UK Government has released guidelines to help business understand the new regulations import and export guidelines, but we're going to outline the main points and keep it simple, - unless you'd like to read Boris' 2000 page agreement!.

So from 1st January 2021, every business will need to make a customs declaration when they send into the EU from the UK (and back again), and this needs to contain some mandatory information, such as an HS code and an EORI number. Now, don't go glazy eyed with confusion just yet, we'll explain it below, and if you ship with Interparcel, we'll also walk you through as part of the booking process. We've taken care of all the changes for you!

What's included in a customs invoice?

Customs invoices are used by customs in foreign countries to assess the goods, value, and reason for Import / Export and calculate the cost of tax and duties payments. For you keen international shippers, you'll be used to providing much of this information already when sending outside of Europe, but there are some mandatory additions now when sending to and from Europe.

Included within a customs declaration is:

- A description of contents (e.g. item type, quantity)

- The value of each item type

- A HS Tariff Code or Commodity code for each item

- Your EORI number

We'll briefly look at the customs invoice, but the main focus will be the HS Tariff code for this blog...

Customs Invoice deep dive:

Tax Status

Are you a private (non-commercial) sender, or a VAT registered or unregistered company?

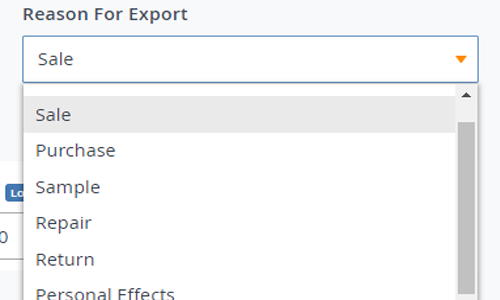

Reason for export

What purpose is your shipment, e.g. a sale or a return?

Item type

What is your item? (Book, Hat, Bike etc.)

Quantity

How many of this item are you sending? If you intend on sending other items, you can add these below with their individual details.

EORI Number

Business sending into Europe now have to supply their EORI number. Currently, we are only making that mandatory for a VAT registered business. If you haven't already registered for yours, you can contact HMRC to receive one. We'll not spend too much time on this here as we have a whole blog dedicated to EORI EORI number: What is it and Do I need one

Value

How much are your goods worth? We'll help you list this item by item.

HS code

HS stands for Harmonized System and refers to an international product naming system developed by the WCO (World Customs Organisation). Said plainly, it says what your items are.

If you want to ship goods to anywhere in Europe or the rest of the world from the UK, having a UK tariff code will speed up the whole customs clearance process, but in addition, it's now mandatory for all shipments to and from Europe.

The code is made up of six digits within Europe (8-10 outside of Europe) drawn from over 5000 commodity groups. Each of these groups has 99 chapters, and each of these has 21 sections. Although arranged in a logical structure, it can be very overwhelming. It can be tough to find and drill down to find your item type with so many chapters. So we've tried to make it as simple as we can to speed the whole process up for you.

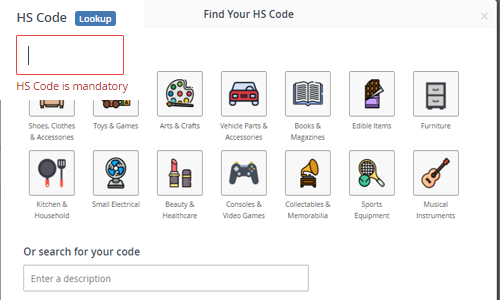

To start, we've put together a few categories of our most commonly sent item types so you can click and go. We also have our commodity code lookup tool in our customs invoice area to simplify this for our customers, as displayed below.

Not one of those? Then use our handy lookup tool. Our tool enables you to free type your item. Then you can click through the relevant subcategories to nail down the specifics. Finally, you will be presented with your HS code, and we will populate this on the invoice for you, magic!

I can't find a HS tariff code for my item, what do I do?

Here are a few examples of the process:

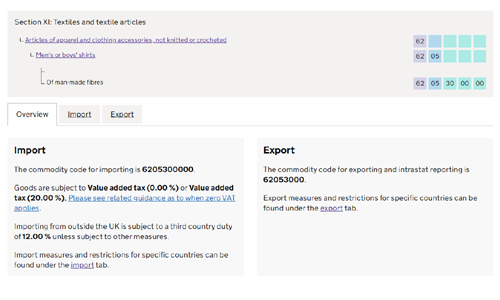

Example 1

David wants to ship a t-shirt.

To find his code, David will need to know:

- How it was made (machine-made)

- If it's for a man or a woman

- What it's made of (his t-shirt is 30% cotton and 70% polyester)

This information would translate to:

- 'Articles of apparel and clothing accessories, not knitted or crocheted'.

Then, continuing to the first sub-section,

- 'Men's or boys' shirts'

Continuing to the next,

- 'Of man-made fibres'

David's commodity code would then be:

- 6205300000 for importing, and

- 62053000 for exporting

For that last section, as the t-shirt is made up of more polyester than cotton, you select the sub-category that refers to the larger quantity.

Additionally, if David decides to send a pair of socks that comes with the t-shirt as a set, he would use the commodity code of the more significant item (the t-shirt). But, if the items he's sending aren't a set, David would need to list each tariff code.

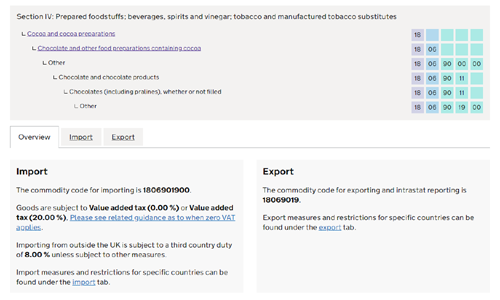

Example 2

Anna wants to send a bar of chocolate.

To find her code, she will need to know:

- What its made of (Cocoa & Milk)

- What form it's in (Chocolate bar)

- Whether it contains alcohol (No)

In Customs language, this will translate to:

- 'Prepared foodstuffs; beverages, spirits and vinegar; tobacco and manufactured tobacco substitutes'

Then

- 'Cocoa and cocoa preparations'

Continuing on to,

- 'Chocolate and other food preparations containing cocoa'

As her chocolate bar doesn't exceed 2kg, she will choose 'other' and then 'chocolate and chocolate products' and finally,

- 'Chocolates (including pralines), whether or not filled' and then 'other'

Anna's commodity code would then be:

- 1806901900 for importing, and

- 18069019 for exporting

Both David and Anna would then enter their UK commodity codes into their customs declaration form when completing the booking process with us.

Whilst it feels like a pain to give information you've never had to before, this little code will speed up the entire customs process. Having the correct corresponding UK tariff code for your shipment is essential from here on out, don't guess or randomly select, you don't want to cause your shipment to be pulled aside to be reclassified!

Manufacture location

What country was your item(s) manufactured?

So after putting you through all the heavy stuff, let's end on a high! Part of the Trade Agreement means it is now even cheaper to send into Europe. From 1st January 2021 shipping costs to and from Europe are no longer subject to VAT. However, your goods may be subject to customs charges.

Shipping VAT is now only payable on shipments within the UK & Northern Ireland.

Just be sure to enter the correct manufacturer location on the customs invoice and be aware that if your item or part of your item contains anything that originated from outside of the UK or EU, charges may be applicable. You can read more about this on the Rules of origin page on HMRC.

Your customs invoice is complete! As long as the information you've provided here is accurate, your parcel is now ready to be shipped. Whether that's to the EU or the rest of the globe!

Make shipping in 2021 easy with Interparcel

We may have tumbled out of 2020 into 2021, with all these changes coming at the eleventh hour. But sending to and from Europe doesn't need to be difficult now we've left the EU, in fact we've done all the hard slog for you! so now get shipping in 2021 with Interparcel!

See, leaving the EU really wasn't that bad, was it?!

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube