On 1st March 2023, the EU introduced the second release of its Import Control System 2 (known as ICS2).

No matter the reason for sending a parcel to the EU, you will be impacted by the new ICS2 regulations. To simplify things, we’ve created a quick guide to explain what these changes are, how these changes affect the way you ship EU-bound packages, and how we can make the process easier.

What is ICS2?

ICS2 is a newly updated “large-scale EU information system.” It is designed to make sending to the EU more secure and efficient. New customs rules apply to air shipments (excluding documents) travelling into or through the EU*, Northern Ireland, Norway, and Switzerland.

HS codes are now compulsory on all customs forms for goods shipped in and out of the EU, no matter the reason for export or value of goods. Alongside HS codes, senders must provide a detailed and accurate description of each item in their parcel.

The final release of ICS2 is expected on 1st March 2024, which will affect roads, rail, and maritime shipments.

* EU countries include Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden.

How does this change affect me?

All goods being shipped into or transiting through the EU or Northern Ireland, Norway, and Switzerland by air will need to have the following:

- A minimum 6-digit Harmonised System (HS) code for each item in a parcel

- An accurate item description explaining what the article is, what it’s made of, and its use

- The above information on the shipping application and commercial invoice

- Receiver's EORI number on the commercial invoice (if required)

Failure to provide the above information could result in customs delays, additional fees, or the parcel being returned at your expense. Therefore, we recommend familiarising yourself with these changes before sending a package to Europe.

What do I need to do?

Luckily, when you book a European parcel delivery through Interparcel, you must provide all this mandatory information to complete your booking. If you’ve never sent a parcel to the EU before or you need a refresher, here is what we mean:

Harmonised System (HS) Code

HS codes are international product naming numbers. You must provide an HS code for each item you ship to the EU and beyond.

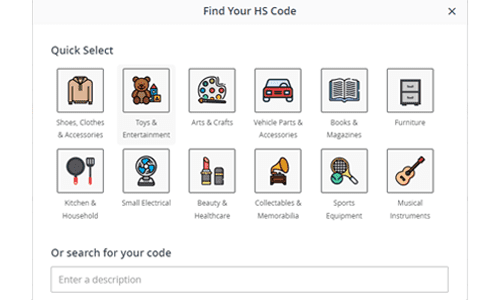

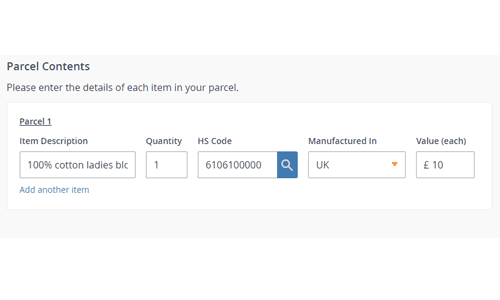

In the 'Customs Invoice' section of the booking process, you must enter the details of each item and the relevant HS code for each item in your parcel. If you don’t know the HS code, a 'Quick Select' menu will appear, allowing you to choose from hundreds of up-to-date HS codes.

Write a detailed item description

During booking, you can add a short, accurate description of your EU-bound goods in the 'Products Contents' section and 'Customs Invoice' section. Vague or generic descriptions such as “clothes” or “toys” will no longer be accepted. Customs require an accurate description to correctly identify the product and determine if any tax or duties are due.

Be as obvious as possible if you’re unsure how to describe your item. For example, don’t just state ‘clothes’ if you’re sending a shirt. Instead, consider the following:

What is the item?

For example, a women’s size 8 blouse

What is the item made from?

For example, 100% cotton

What is its use?

For example, casual summer wear

So, all together: Women’s size 8 casual summer blouse made from 100% cotton.

Receiver’s EORI number

If you’re sending a parcel to an EU business address, we recommend you supply the receiver’s EORI number to speed up the customs process.

Send a parcel to Europe with ease

You can compare and book a discount European courier service and complete all necessary documentation in simple steps. Enter your parcel details into our online quote tool or via Shipping Manager.

Of course, if you have any questions about sending to Europe, you can contact our friendly parcel experts, seven days a week, via telephone, live chat, or email. Further information on ICS2 is available on the European Customs website.

Disclaimer: Interparcel does not claim to be financial, legal, or customs experts. This blog post is for informational use only. You should always conduct your own research to verify the accuracy of this content. The information was accurate at the time of writing but may be subject to change.

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube