Don't know the differences between your B2B, B2C and C2Cs in regards to VAT? Not to worry! In this blog, we break down the technical jargon and aim to help you understand all you need to know about the new European Union (EU) VAT and Customs changes and the new Import One-Stop Shop.

What is happening?

On 1st July 2021, The EU is updating its VAT system for goods imported from outside the EU. As the UK is no longer part of the EU, British-based eCommerce companies who sell across the EU will be affected.

New VAT Rules

- Currently, there is no VAT applied for Business-to-Consumer (B2C) shipments under €22

- From 1st July 2021, there will be VAT applied on ALL goods, regardless of their value. This will impact e-commerce businesses and online marketplaces

- VAT is charged at the rate set in the buyer's delivery location

- Any parcels under €150 (£135) will require the buyer to pay VAT, Formal clearance and a Customs clearance fee

- Any parcels above the €150 (£135) threshold will require international customers to pay VAT, Formal Clearance, Customs Clearance fee and duties

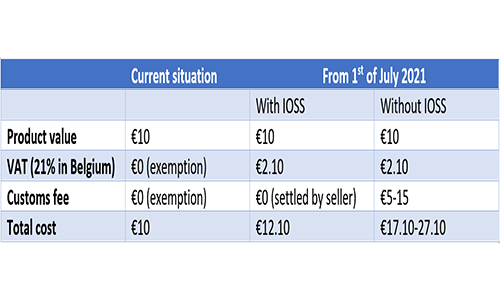

Can I have an example?

- Sure! Imagine you were a seller registered in Cyprus, and you are sending a €10 notebook to Belgium

- The Cyprus VAT rate is 19%, but Belgium is 21%

- You would still report and pay your VAT in Cyprus but at the Belgian 21% VAT rate as that is the delivery country

The Import One-Stop Shop (IOSS)

- The IOSS is an electronic portal designed for businesses to use in order to meet their VAT e-commerce obligations on distance sales of imported goods

- The IOSS will allow companies to report and pay EU VAT via one portal rather than in each individual country

- The IOSS aims to offer a hassle-free shopping experience where the seller is responsible for VAT declarations and payments

- The member states then pay the applicable VAT to each other directly

- UK businesses can opt in to IOSS through an intemediary, this will incur fees

What does this mean?

- IOSS is only for Business-to-Consumer (B2C) shipments. Customer-to-Customer (C2C) and Business-to-Business (B2B) are not affected by this change and are not eligible to apply for IOSS

- It is cheaper for the receiver to use IOSS as they will only pay VAT and no Customs fees. It also speeds up delivery as everything is paid beforehand

Can I have an example?

- Imagine you are sending a €10 notebook to a customer in Belgium from outside of the EU, and Customs clearance takes place in Belgium

- With IOSS, you will charge VAT at the point of sale for Belgium and convey the payment to the authorities, clearing the goods through Customs

- Without IOSS, Customs will charge VAT upon delivery which customers will have to pay on top of Customs charges

- This is only for Business-to-Consumer sales for items up to €150 (£135). If there are multiple €10 items in a package, it may bring it over the threshold

Do I have to use IOSS?

- Shippers do not have to register for IOSS, however extra administration will be required upon import of the parcel and the customer will have to pay additional fees

- The shipment could be delayed upon arrival and there will be pending fees for the customer, resulting in a longer delay in the goods reaching the consumer

- If using IOSS the charge is the standard VAT of the receiving country and is processed at the start of the delivery process

So…what are the benefits of these new rules?

- The new rules are designed to simplify and regulate the taxation of goods for EU businesses resulting in an equal trading environment for all

- The VAT rate applied to goods bought outside the EU will be the same as goods purchased in their home country

Are there any actions I need to take?

If you are a business selling to individuals in Europe and would like to participate in the IOSS, please read our IOSS blog for further information.

I want to send a gift to a friend abroad, do I need to register?

No, if you are sending a gift to a friend or relative abroad you would be classed as a Consumer-to-Consumer (C2C) shipper so the IOSS changes do not affect you. However, you will still need to complete a Customs invoice for the parcel. If you need help on this our Customs invoice blog will take you through the sections you will encounter and advise on how to fill it in.

I am a business with multiple items to send to individuals, what do I do?

IOSS can only be used if the total value of contents is under €150 (£135). If a customer has purchased multiple small items from your store and the total is over €150 (£135) then IOSS cannot be used, and Customs will calculate the VAT at the point of entry, and the receiver will be charged directly. If you are selling items that will go over the threshold, it may be more cost-effective to sell and dispatch in multiple orders.

What if I sell my products on an online marketplace like Amazon or Etsy?

Amazon, Etsy, or other online marketplaces have set up their own IOSS as they are responsible for VAT instead of the seller and can represent multiple sellers under one IOSS ID number. They will issue you with an IOSS number that you must declare on the Customs invoice to confirm VAT has been paid. Remember, this only applies to goods worth €150 (£135) or less. If you are using the IOSS you must declare your IOSS number on the Customs invoice.

What if I am a business selling to another business?

If you are a Business-to-Business (B2B) seller then you cannot use IOSS and are not affected by these changes. But you should obtain a customer's VAT number as evidence they are a business customer.

What does the €150 (£135) limit mean?

Goods shipped in a single package with a total of €150 (£135) refers to the price of the goods themselves and excludes any insurance or transport cost.

I am from Northern Ireland, is any of this relevant to me?

No, IOSS is for non-EU eCommerce sellers marketing goods to EU customers who ship into the EU after the sale. Northern Ireland firms can join an alternative 'One Stop Shop Scheme' (OSS).

Do other non-EU countries have a separate VAT system?

Yes, Norway for example, have declared a new registration scheme called VOEC (VAT On E-Commerce). The seller or marketplace must charge the Norweigan VAT rate at 25% on transactions below NOK 3,000. Similar to the IOSS system, if a business sells goods through its own eCommerce store, the seller must calculate and pay VAT on the goods. If an intermediary assists the supply of goods, the intermediary is regarded as the supplier for VAT purposes. If a business does not register for VOEC then goods could be blocked at the border and the customer will have to pay VAT to clear it.

Please note: Interparcel do not claim to be financial, legal or customs experts. This blog is for information use only and you should always carry out your own research to verify the accuracy of this content. Please note, the information above may be subject to change. For more information, please read the official guidelines.

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube